The SEC has ended its investigation into the Zcash Foundation. The agency informed the nonprofit that it will not recommend any enforcement action or regulatory changes. This decision removes a legal uncertainty that had followed Zcash for over two years.

The investigation began in August 2023. The SEC issued a subpoena as part of a broader look into crypto asset offerings. The agency sought information on Zcash’s funding, governance, and token distribution. It examined whether these activities might fall under U.S. securities laws.

Like many probes from that period, the inquiry focused on whether the project resembled an unregistered securities offering. Zcash’s privacy features and its U.S.-based foundation drew added regulatory scrutiny. Now, the SEC has closed the matter without recommending any charges, fines, or compliance changes.

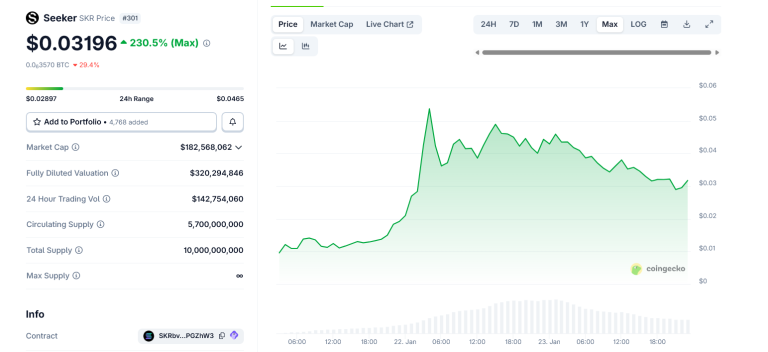

Following the news, the price of ZEC, Zcash’s token, rose sharply. It traded near $440, an increase of about 13% on the day. Trading volume was heavy as the market priced in lower regulatory risk.

This price move also came after days of internal conflict within the Zcash ecosystem. Last week, the entire core development team at the Electric Coin Company resigned. They left after a public dispute with the Bootstrap Foundation, which oversees Zcash governance.

The developers accused the foundation’s board of imposing changes that made their work impossible. They described the situation as a constructive discharge. This news had triggered a sharp sell-off, with ZEC falling more than 20% in days.

Since the resignation, stakeholders have clarified that the Zcash blockchain remains decentralized and operational. The development team is restructuring as a startup. Independent developers, node operators, and miners continue to run the network.

The SEC’s decision to close its investigation removes the project’s largest remaining regulatory threat. Combined with efforts to resolve the internal governance crisis, this has helped restore some market confidence in Zcash.