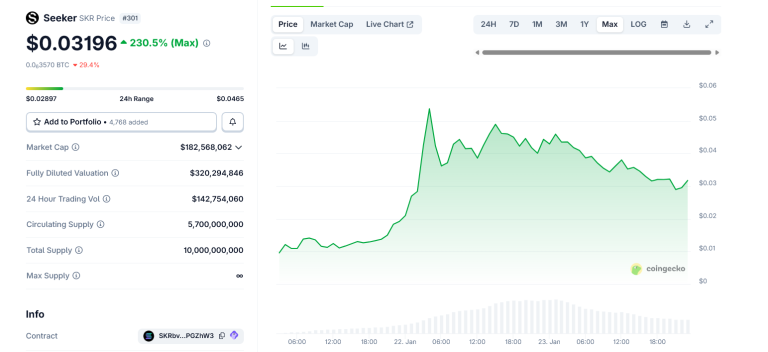

The price of Seeker has fallen sharply. It is down nearly 70% from its post-launch high of around $0.067. The token is now trading near $0.024. The initial excitement has faded, and buyers are not actively defending the price.

The main question is whether the price can avoid falling further. Currently, this depends more on sellers than on buyers. Technical indicators show persistent selling pressure.

Money flow data has been negative since late January. This means capital is flowing out of the asset, not into it. The Relative Strength Index also shows weakening momentum, failing to match recent price highs.

On-chain data supports this bearish view. Exchange balances for Seeker have increased by over 5% in 24 hours. When tokens move to exchanges, it often signals an intent to sell. Holdings by sophisticated investors have also dropped, showing no significant buying during the dip.

In simple terms, there is a lack of spot market demand. After a 70% drop, buyers would typically step in. They are not doing so, which is concerning.

With spot buyers absent, the next price move may be decided by leveraged traders. A map of potential liquidations shows where these traders could be forced to close their positions.

On the Bitget exchange, bearish short positions dominate bullish long positions by more than 100%. If the price were to rise toward $0.030, it could trigger a short squeeze. This is when sellers are forced to buy back their positions, potentially causing a sharp price increase.

Without such a squeeze, the path of least resistance appears to be down. The analysis suggests the price could break down by another 17%, targeting a level near $0.019.