Uniswap’s UNI token is trading near $3.40, up about 3% in the last day. This small move masks a dramatic event on February 11. That day, UNI surged nearly 42% to a high near $4.57. The catalyst was news linking Uniswap to BlackRock’s expansion into tokenized funds.

Since that peak, sellers have erased roughly 26% of the rally. This raises a question: was the breakout a genuine trend change, or a trap for retail buyers?

The February 11 rally was driven by retail momentum. Analysis of the On-Balance Volume (OBV) indicator shows a breakout coincided exactly with the BlackRock news. This indicates retail traders reacted aggressively to the headline, rushing to buy UNI.

However, the structure of the price surge gave early warnings. The breakout candle on the chart formed with a very long upper wick and a small body. This pattern shows buyers pushed the price up, but sellers absorbed most of the move before the period closed. It was a sign of strong selling pressure near $4.50.

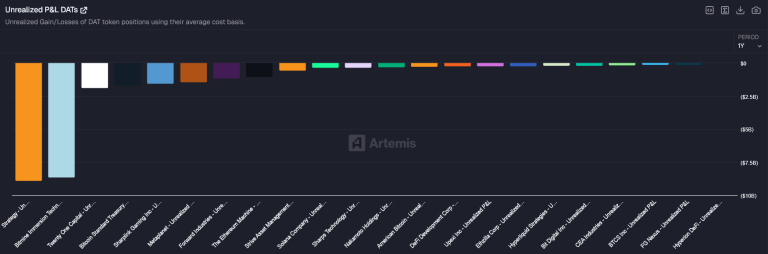

Data shows this selling pressure came from large holders, or “whales.” Around the $4.57 peak, whales sold approximately 5.9 million UNI tokens. This was not random profit-taking but coordinated distribution by large wallets.

While retail buyers chased the breakout, whales were exiting their positions. This explains why UNI failed to hold above $4.50 and why the rally collapsed quickly. Once large holders finished selling, buying momentum weakened and the price fell.

The rapid 26% drop from the peak likely pushed many late buyers into immediate losses. The event effectively provided liquidity for whales to sell into. Retail demand met whale supply.

On shorter-term charts, the rally had also reached a logical technical completion. Prior to the news, UNI had formed a reversal pattern. The surge to $4.57 fulfilled the measured price target of that pattern, giving technical traders a reason to sell.

The key level to watch now is around $3.21. If UNI fails to hold this support, the price could decline further toward $2.80. Such a move would erase most of the gains from the BlackRock news event.