Bitcoin’s price dropped sharply just before the 17th anniversary of its whitepaper. The value fell below $107,000. This decline caused the holdings linked to Bitcoin’s creator, Satoshi Nakamoto, to lose nearly $5 billion in a single day.

Data from Arkham Intelligence showed the value of Satoshi’s wallets fell to around $118 billion. Despite this loss, the holdings remain larger than the wealth of individuals like Bill Gates. The price drop continued after this report was published.

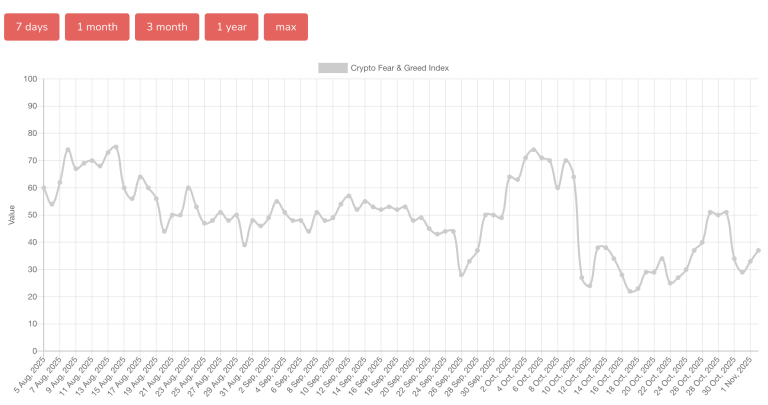

This market movement occurred despite a recent interest rate cut by the U.S. Federal Reserve. Such a cut would normally be expected to boost prices for assets like Bitcoin. Instead, both retail and institutional investors pulled back from the market.

This retreat signals a deeper concern and a lack of confidence among traders. Market analysts suggest that the current sentiment is trending toward fear. The significant loss in Satoshi’s symbolic holdings on this anniversary is seen as a potent negative symbol.

Experts are also pointing to Bitcoin’s growing ties to major governments. They argue this contradicts the original vision of a stateless, decentralized currency. One analyst suggested this connection could allow for a “controlled demolition” of the industry’s value by authorities.

In the cryptocurrency world, narratives and symbols heavily influence investor sentiment. The combination of a major price drop, weakening confidence, and a symbolic loss on an important anniversary creates a fragile moment. Without renewed confidence from everyday investors, such price declines can accelerate rapidly.