Bitcoin has entered November, its strongest month for gains historically. Since 2013, the price has increased by an average of 42.51% during this month. If this pattern continues, Bitcoin could potentially surpass $160,000 this November.

However, a crypto analyst noted that seasonal trends are just one factor. Markus Thielen from 10x Research stated that these charts must be combined with other macroeconomic developments to be meaningful.

Several key events could influence the market. Expectations are growing that the US Federal Reserve will lower interest rates further. A trade deal between the US and China is also being negotiated. Both of these developments are generally seen as positive for Bitcoin.

Yet uncertainty remains. A prolonged US government shutdown and ongoing tariff discussions continue to create economic instability.

Recent talks between the US and Chinese presidents were described as positive. The US agreed to reduce some tariffs in exchange for Chinese concessions on trade and other issues. The US president said he expects a deal “pretty soon.”

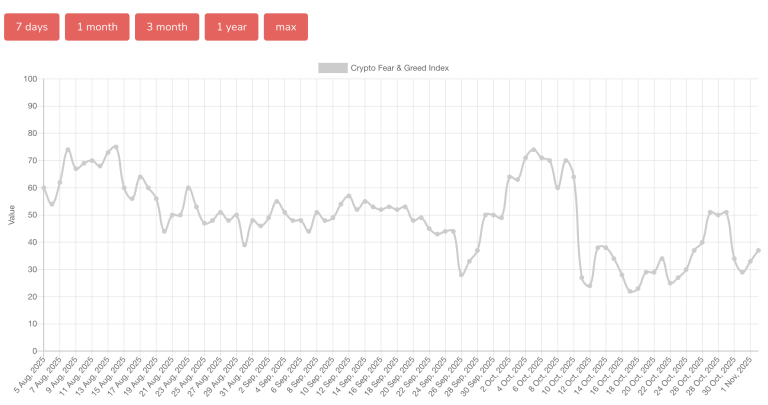

This is significant because earlier tariff threats were blamed for a major crypto market crash in October. The market has struggled to recover since that event. However, one expert cautioned that the meeting may only be a “pause” in the trade war, not its end.

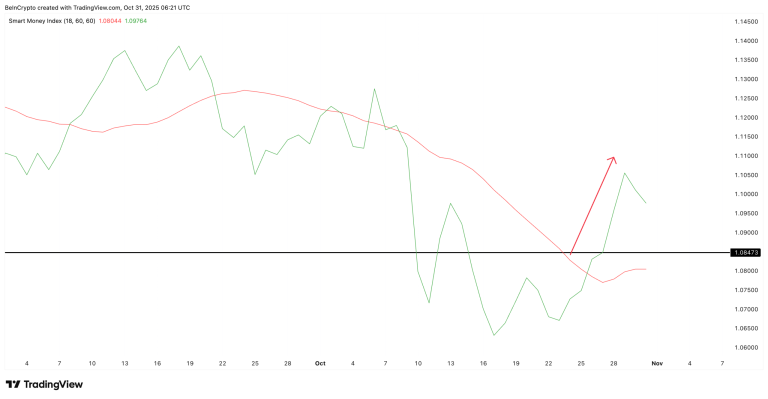

Regarding interest rates, the Fed recently cut rates to a three-year low. The next meeting is in December, and market data suggests a 63% probability of another rate cut. Lower rates typically encourage investment in riskier assets like cryptocurrencies.

Furthermore, the Fed plans to halt its quantitative tightening program in December. This process involves reducing the central bank’s balance sheet to cool the economy. Stopping it is seen as a positive move for markets.

The opposite policy, quantitative easing, injects money into the economy. This often benefits crypto as some of that new capital flows into alternative assets.

Meanwhile, the US government shutdown is nearing its fifth week. The president has called for a rule change in the Senate to break the political deadlock. An end to the shutdown is considered necessary for the final approval of several crypto ETFs and for the advancement of major crypto market legislation.