A little-known Solana token called “US Oil” (USOR) jumped over 150% in a single day. Its market value briefly passed $40 million. This surge happened as traders reacted to news about the United States selling seized Venezuelan oil assets.

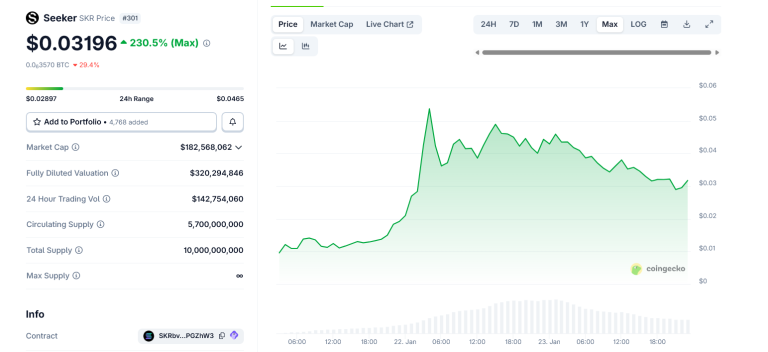

The token became popular on tracking sites. However, analysts and traders warned the rally showed signs of a speculative pump. The price moved in a near-vertical pattern, which many flagged as abnormal.

The project’s website claims USOR is an “on-chain reserve index” that tokenizes US oil reserves. It says the token is oil-backed and governed by transparency. Yet, the site provides no verifiable proof of custody, legal structure, or any link to official US oil reserves.

On-chain data raised red flags. Independent trackers showed a high concentration of the token’s supply held by a small group of wallets. Bubble map visuals suggested these top holders were linked, pointing to centralized control. This creates a risk for late buyers if those holders sell.

Crypto social media was divided. Some traders alleged the narrative was engineered to exploit real-world news. They pointed to coordinated promotion and a lack of organic buying. Others warned the branding mimicked geopolitical events to set up a potential scam.

The token trades mainly on Solana’s decentralized exchanges. Charting platforms displayed “suspicious chart” warnings as volume spiked sharply with the price. There is also speculation it could be an insider move, as it launched on the same platform as another popular political meme coin.

Overall, USOR shows how quickly macro-political news can fuel crypto speculation. Traders are racing to trade the story, even as warnings grow that the story itself may not be true. Whether this is a short-lived meme or something more remains unclear.