Bitcoin traders are building leveraged positions across the derivatives market ahead of a pivotal Federal Reserve meeting this week. The central bank’s interest rate decision on Wednesday has become a focal point for investors, who widely anticipate a quarter-point cut that could bolster appetite for risk assets, including cryptocurrencies.

This sentiment stems from recent economic developments, including labor market data from July and August and a decline in core inflation, which prompted the Fed’s initial cut last month. The ongoing U.S. government shutdown has since created a data vacuum, limiting the Fed’s visibility into the economy. However, recent comments from Fed Chair Jerome Powell on ending quantitative tightening have provided some insight into the central bank’s thinking.

The expectation of another cut is reflected on the prediction market Myriad, where users have assigned a 92.6% chance of a quarter-point rate cut this week. Myriad is owned by Dastan, the parent company of Decrypt.

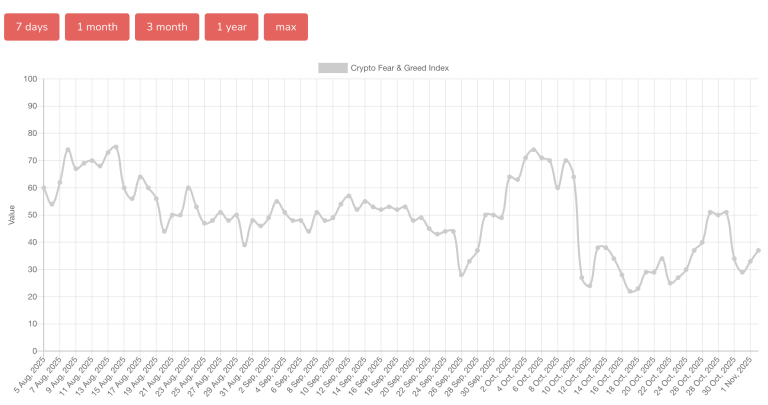

Optimism over the potential policy shift is fueling activity in crypto markets. According to CryptoQuant data, Bitcoin’s aggregated open interest—representing the total value of all open derivatives positions—has surged to $37.63 billion. The cryptocurrency’s rally from $107,600 last week to just above $116,000 has been accompanied by an increase in open interest from $33 billion, indicating investors are positioning ahead of the Fed’s announcement.

It is worth noting that open interest remains below the October 6 level of $47 billion, a period when Bitcoin set a record high of $126,080, according to CoinGecko data. This comes amid a conviction among some analysts that further upside may already be priced in.

“The upcoming FOMC meeting is widely expected to deliver a 25-basis-point rate cut to 4.00–4.25%, a move markets have already priced in,” Gracy Chen, CEO at Bitget, told Decrypt. “Despite the ongoing U.S. government shutdown adding fiscal uncertainty, the Fed’s decision should proceed as planned, as monetary policy operates independently of Congress.”

Chen added that Powell is likely to signal a gradual easing cycle, a combination that points to broader liquidity expansion supportive of risk assets. “Bitcoin’s rebound over the weekend reflects this improving sentiment, with strong ETF inflows and easing trade tensions fueling momentum,” Chen said. “If Bitcoin holds above $112,000, it could push toward $118,000 to $120,000 by month’s end, while rising open interest near $40 billion suggests renewed trader confidence.” Despite the bullish outlook, Chen noted that “leverage-driven volatility remains a risk.”

Source: https://decrypt.co/346292/bitcoin-leverage-nears-40b-ahead-key-fed-vote