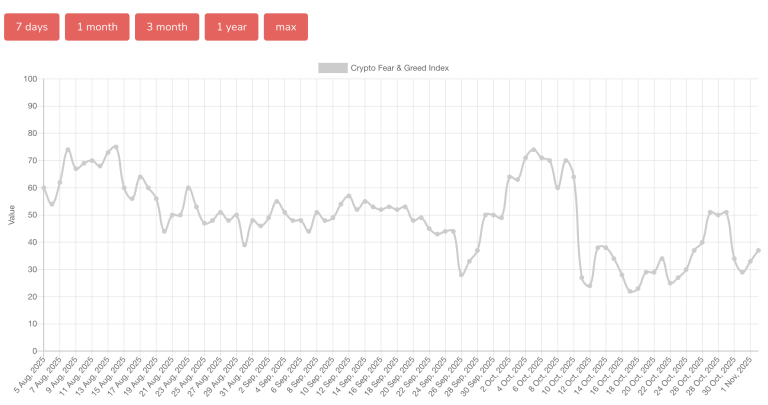

Bitcoin’s price moved mostly sideways in October, gaining only 1.5% for the entire month. However, it climbed nearly 5% in the past week. This renewed focus on a potential bullish reversal. The price briefly crossed $113,200 before being rejected near $115,000. This level is now a critical barrier between hesitation and a stronger upward move.

The rejection appeared sudden, but data suggests it was expected. The failure was linked to activity from large Bitcoin holders. Between October 25 and 28, these holders moved over 10,000 BTC to exchanges. This wave of selling pressure from whales and sharks stalled the breakout attempt despite optimism from smaller traders.

Despite this selling, the broader market trend shows accumulation. The Holder Accumulation Ratio remains above 60%. Any reading above 50% indicates the market is in a net accumulation phase. This means long-term buyers are quietly purchasing Bitcoin. Their activity helps absorb the coins being sold by short-term traders. This prevents deeper price drops and helps maintain market stability.

From a technical perspective, Bitcoin’s chart shows an inverse head and shoulders pattern. This is often seen as a signal for a shift from selling to buying momentum. The pattern remains valid as long as Bitcoin holds above $106,600. This price acts as the base, or support, for the formation.

A key momentum indicator, the Relative Strength Index (RSI), recently showed a warning sign. Between October 13 and 26, it displayed a hidden bearish divergence. The price made a lower high while the RSI made a higher high. This signaled that upward momentum was weakening, which foreshadowed the failure near $115,000.

That divergence has now flattened out. The RSI and Bitcoin’s price are moving in sync again. This stabilization suggests sellers are losing steam and a recovery could be building strength. The key level to watch remains $115,000. A decisive close above this price could open a path toward $117,300 and even $125,900. A failure to break higher, followed by a drop below $106,600, would invalidate the bullish setup and could push the price toward $103,500.