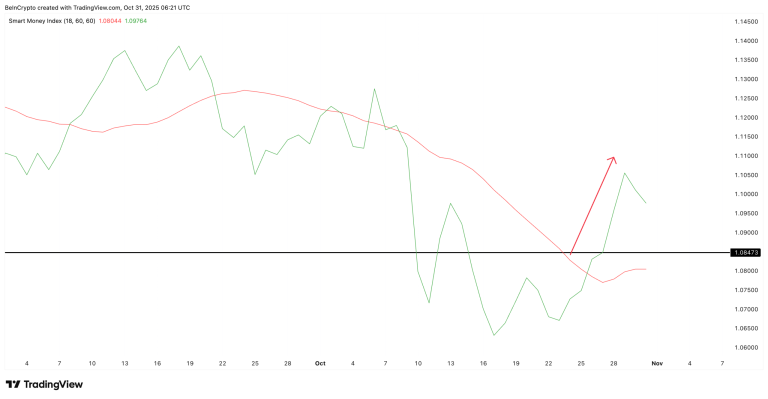

A key measure of crypto market sentiment remains in uncertain territory. This is despite a new trade deal between the United States and China. The agreement was announced by US President Donald Trump.

Some analysts believe the deal could soon boost the crypto market. The industry watches US-China trade relations closely. Past tariff announcements have often caused major crypto price swings.

On April 9, Trump suspended some tariffs for 90 days. In response, the Crypto Fear & Greed Index surged. It jumped from a score of 18, indicating “Extreme Fear,” to 39, indicating just “Fear,” within a day.

Conversely, a recent threat of 100% tariffs from Trump was blamed for a market crash. On October 11, about $19 billion was liquidated in 24 hours. The market has found it difficult to recover from that event.

Analyst Michael van de Poppe commented on the situation. He suggested the market might later look back on this period as a bottom. He believes the market is still in the early stages of a bull cycle for both Bitcoin and other cryptocurrencies.

The White House confirmed the suspension of heightened tariffs will continue. It is now set to last until November 10, 2026. This provides a longer period of trade certainty.

This clarity has been met with optimism by some traders. One trader, Ash Crypto, called the development “Bullish for markets.” Another trader, 0xNobler, described it as “GIGA BULLISH NEWS.”

So far, the new trade deal has not caused a major market shift. Bitcoin’s price is around $110,354. Ether is trading near $3,895. Both saw minor gains of less than 1% over the past day.