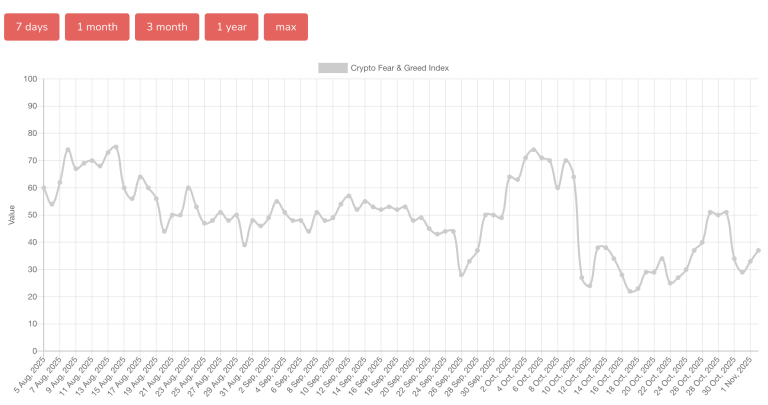

Hedera’s HBAR token has gained over 14% this week, recovering from a recent slump. However, the price remains down nearly 9% for the month, indicating a clear downtrend. This creates a confusing picture with mixed signals from different market participants.

Data shows that retail traders and smart money are still bullish. The Smart Money Index, which tracks experienced traders, has been rising since late October. This index is above its signal line, suggesting these traders expect a rebound. As long as the index stays above a key level, the short-term outlook remains positive. A drop below that level, however, could quickly turn sentiment negative.

In contrast, large wallet holders, known as whales, are acting differently. Since October 21, the share of HBAR supply held in the largest wallets has fallen from 41.75% to 40.65%. This means whales have moved at least 110 million HBAR out of their accounts in less than two weeks. At current prices, this represents over $20.9 million leaving the hands of major holders.

This creates a classic market split. Smaller traders and smart money believe the worst is over and are betting on further gains. Meanwhile, the largest holders appear to be preparing for a potential price drop by taking profits or exiting their positions.

This whale activity is a significant warning sign. Technical analysis of the price chart also shows a hidden bearish divergence. This suggests that the recent price rise might be losing momentum. If the price fails to hold a key support level around $0.168, it could trigger a deeper decline. The actions of the whales may be a signal that such a correction is coming.