Instead of asking how much a project promises, I wanted to understand how it actually works on-chain.

So I decided to do something most people don’t do.

I stopped reading the website.

I stopped listening to marketing.

And I went straight to the blockchain.

I wanted clear answers to very simple questions:

- How much money users have actually deposited

- Where those funds really go

- How the protocol uses this capital

- And whether the system makes sense from a technical perspective

This article is not a theoretical overview.

It is a step-by-step on-chain investigation of Cyrus Finance, using real data from Binance Smart Chain and PancakeSwap — so anyone can verify everything themselves.

Forget the Website. Open the Blockchain

The first rule of any serious DeFi analysis is simple:

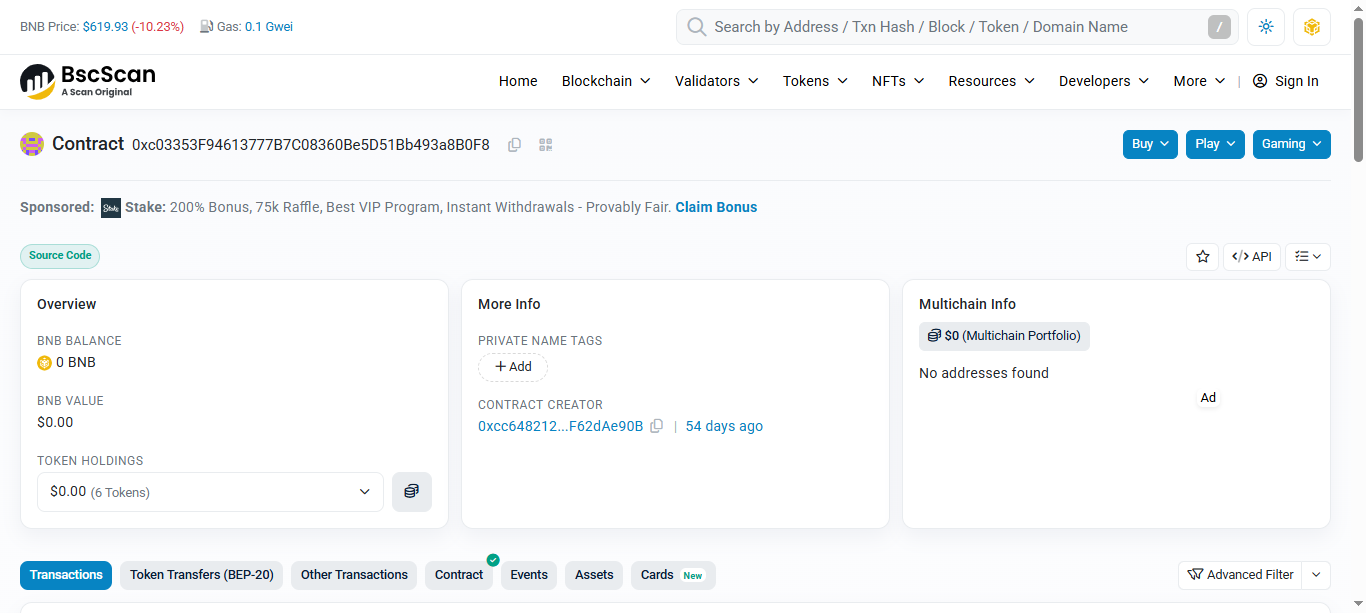

If something really exists, it exists on-chain.The starting point for Cyrus Finance is the vault smart contract — the contract that receives user deposits and routes funds further.

Cyrus Finance Vault Smart Contract (BSC) Address: https://bscscan.com/address/0xc03353F94613777B7C08360Be5D51Bb493a8B0F8

This is the core contract responsible for receiving user deposits, opening positions, distributing funds into liquidity strategies.

Anyone can open this address on BscScan and see every transaction. every deposit, every interaction with the protocol.

I opened this page on BscScan because it gives me everything I need to verify the protocol:

- contract activity (transactions)

- contract logic (code)

- and real on-chain interactions

What Happens When a User Deposits Funds

Next, I wanted to understand what happens after a user makes a deposit.

So I did two things:

- I opened Contract → Code to check the logic.

- I opened Transactions to confirm that the logic is actually used in real activity.

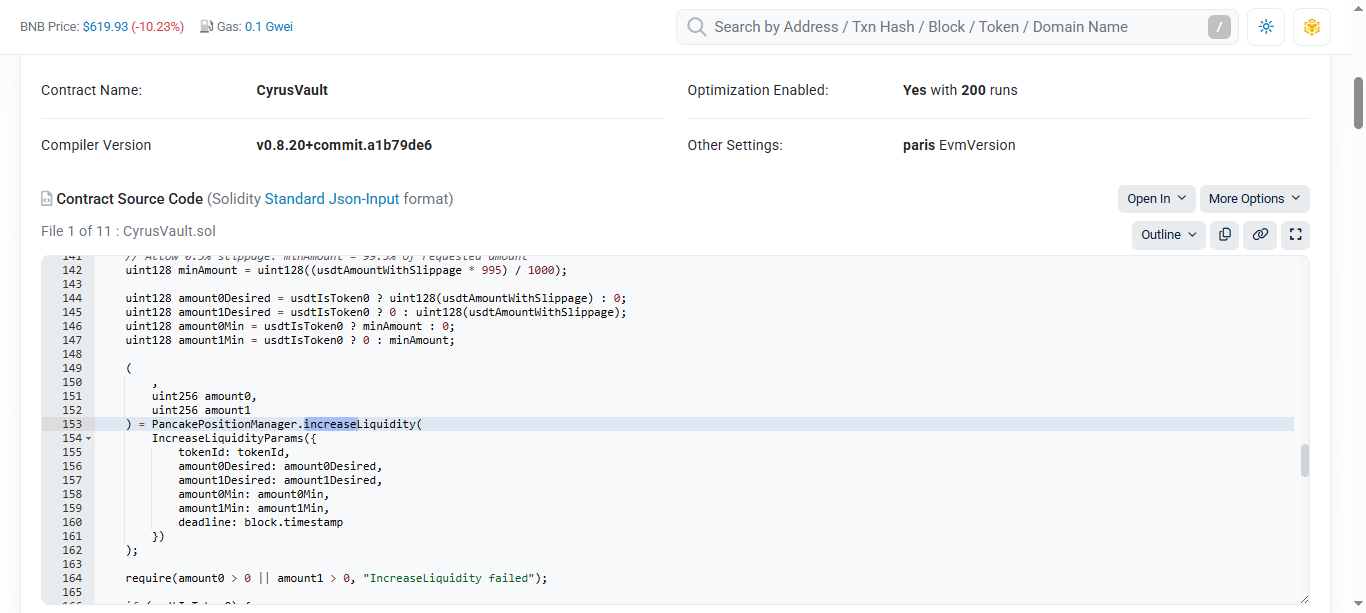

Inside the vault contract code, I looked for the part that proves whether funds are: just stored inside the contract, or deployed into real DeFi infrastructure.

The key proof is a direct call to PancakeSwap’s V3 Position Manager:

PancakePositionManager.increaseLiquidity(...)In simple terms, this means:

deposited USDT is used to increase liquidity in existing PancakeSwap V3 positions (identified by token IDs). So the protocol is not “faking” liquidity — it’s interacting with public, verifiable DEX positions.

At this point, I needed the exact liquidity positions used by the protocol — that’s where token IDs come in.

Why Liquidity Pools Matter (Explained Simply)

At this point, I realized that it’s important to explain why sending funds into liquidity pools matters at all — especially for those who are not deeply familiar with DeFi.

When money is placed into a liquidity pool, it does not just sit somewhere inside a smart contract, It actively works.

Liquidity pools are used by traders to swap assets on decentralized exchanges. Every trade generates a fee, and these fees are distributed among those whose funds are providing liquidity.

In simple terms, a liquidity pool is a place where money makes money.

This is the key difference between funds that are simply stored and funds that are actually deployed:

- stored funds are idle

- liquidity funds participate in real market activity

- and yield is generated from trading fees, not from internal accounting or promises

That’s why it matters when a protocol sends user deposits into real liquidity pools instead of keeping them locked inside a contract.

When I saw that Cyrus Finance deploys funds into PancakeSwap V3 liquidity positions, it showed me that: the capital is not sitting still, it is used in real DeFi infrastructure and it generates yield through ongoing market activity.

This makes the entire system far more transparent and easier to verify on-chain.

Tracking Real Liquidity via PancakeSwap Positions

At this point, I moved from contract logic to real liquidity verification.

My goal here was simple:

to prove that the funds deposited into the protocol are actually deployed into real liquidity pools on PancakeSwap — and not just shown as numbers inside a contract.

To do that, I needed to find the exact PancakeSwap V3 liquidity positions used by the protocol.

PancakeSwap V3 liquidity is represented by NFTs, and each liquidity position has a unique token ID. If I can find those token IDs inside the protocol, I can open them directly on PancakeSwap and verify the liquidity myself.

So the task was clear:

find the token IDs used by the Cyrus Finance vault contract.

How I Found the Token IDs Used by the Protocol

I started with the vault contract on Binance Smart Chain: https://bscscan.com/address/0xc03353F94613777B7C08360Be5D51Bb493a8B0F8

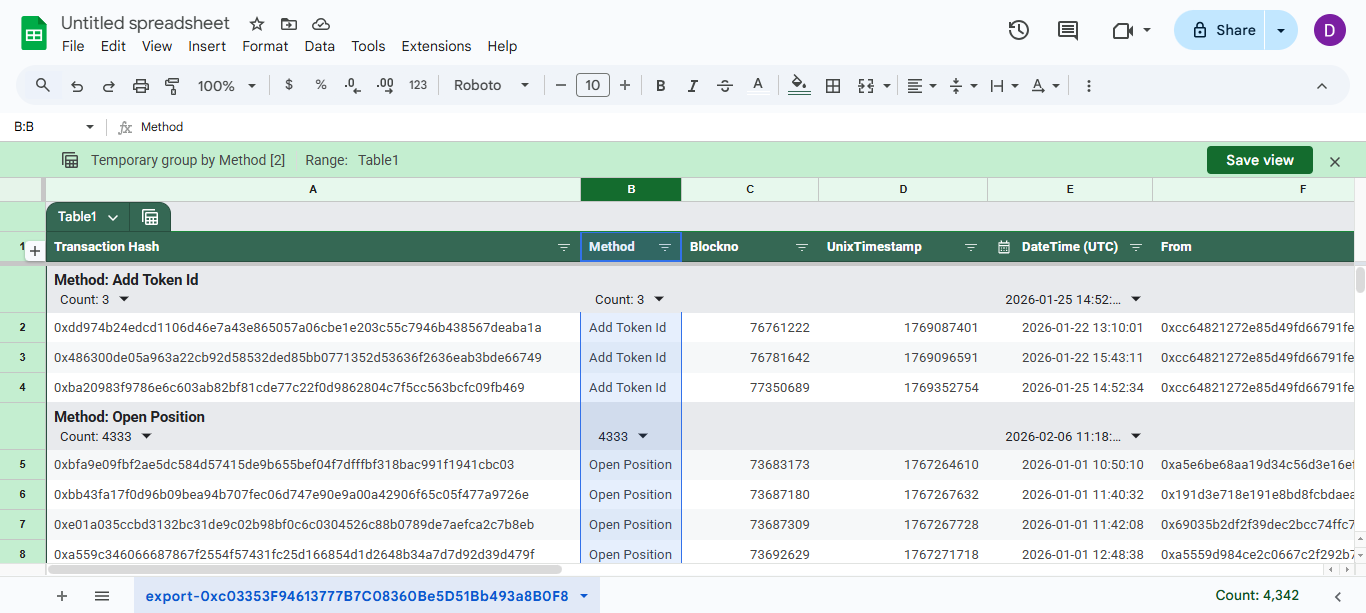

Instead of manually scrolling through thousands of transactions, I used BscScan’s export feature.

Here’s exactly what I did:

- I exported the transaction history of the vault contract into a CSV file.

- I opened the file and focused on the Method column.

- Most entries were openPosition, which are regular user deposits.

- What I was looking for were administrative configuration calls — specifically addTokenId.

These addTokenId transactions are important because they define which PancakeSwap V3 liquidity positions the protocol is allowed to use.

Filtering contract transactions by method to identify addTokenId calls

Extracting Token IDs from the Blockchain

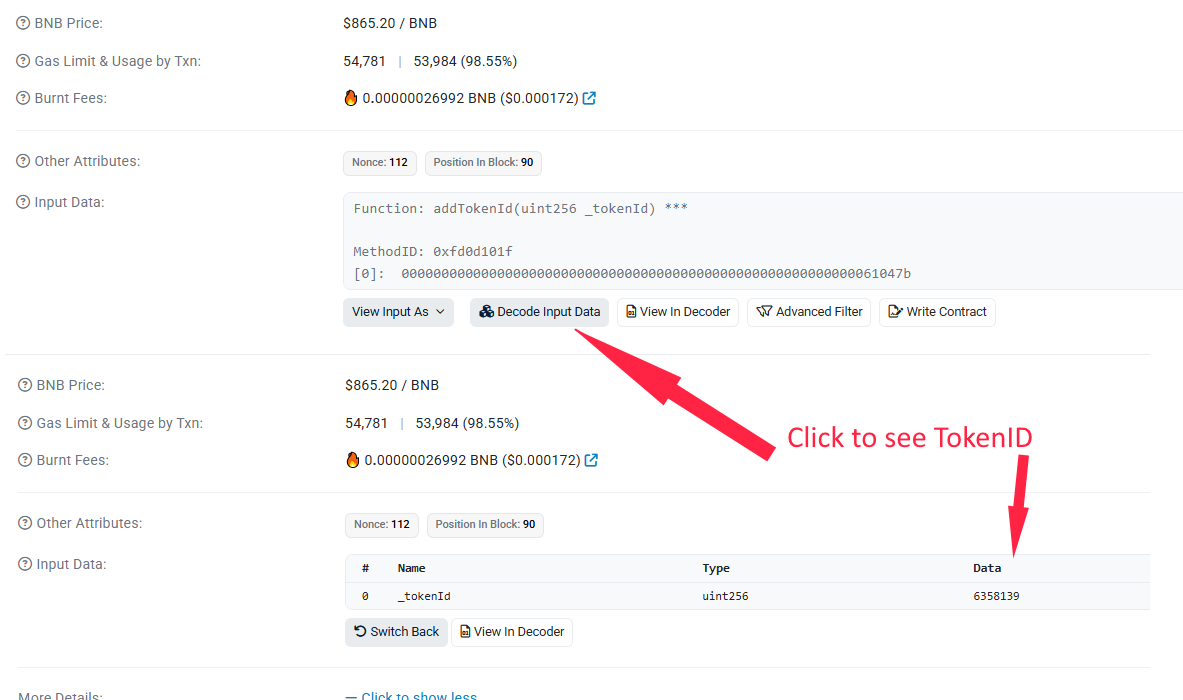

Once I identified the addTokenId transactions, I opened each one directly on BscScan.

Inside every transaction, I went to Decoded Input Data. This section shows the exact parameters passed to the contract — including the token ID being added.

That’s where I extracted the actual PancakeSwap V3 position IDs.

Decoded Input Data showing tokenId value

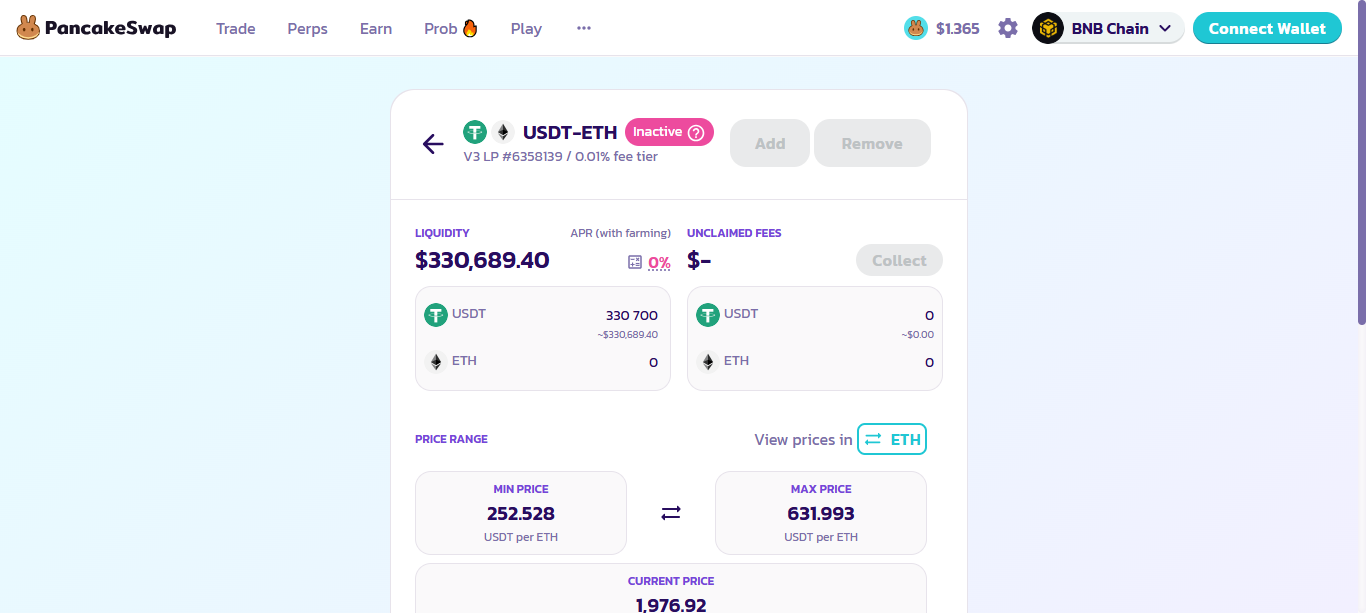

Token ID #1 — USDT / ETH Liquidity Position

The first token ID I found was:

Token ID: 6358139

PancakeSwap link: https://pancakeswap.finance/liquidity/6358139

Opening this page allowed me to directly verify:

- the trading pair (DOGE / USDT)

- the liquidity range

- and the total liquidity value in this position

PancakeSwap V3 USDT-ETH liquidity position linked to Cyrus Finance

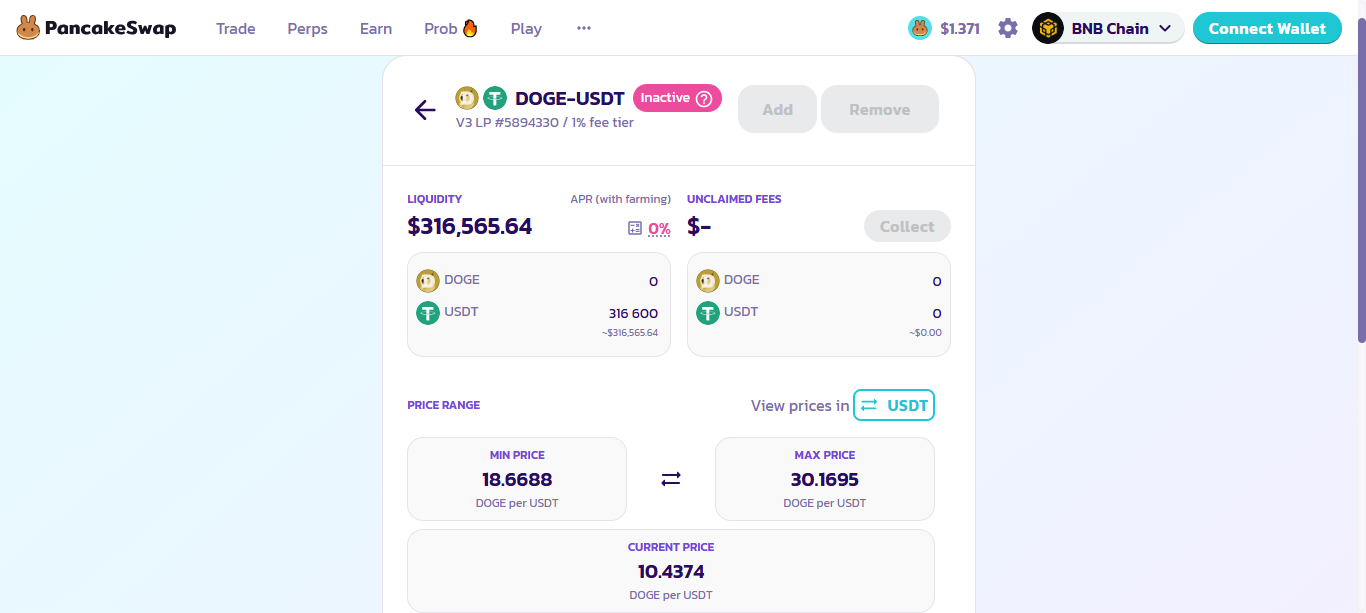

Token ID #2 — DOGE / USDT Liquidity Position

After reviewing additional addTokenId transactions, I found a second active liquidity position:

Token ID: 5894330

PancakeSwap link: https://pancakeswap.finance/liquidity/5894330

This position represents a different trading pair and confirms that the protocol deploys liquidity across multiple pools rather than relying on a single one.

PancakeSwap V3 DOGE-USDT liquidity position linked to Cyrus Finance

Why This Matters

By identifying token IDs directly from the vault contract and verifying them on PancakeSwap, I was able to confirm that:

- user funds are deployed into real, active liquidity pools

- the liquidity exists independently of the website interface

- and anyone can verify the same data without trusting screenshots or claims

This step connects the protocol’s smart contract logic with real, verifiable DeFi infrastructure.

Putting the Numbers Together

Now we can summarize the part that actually matters — real, verifiable liquidity.

After tracing the vault contract and identifying the PancakeSwap V3 positions used by the protocol, I verified two active liquidity pools:

- DOGE / USDT (Token ID 5894330) — around $317,000

- USDT / ETH (Token ID 6358139) — around $328,250

Together, that’s over six hundred thousand US dollars in liquidity deployed across just two positions.

And here is the important context.

This liquidity was accumulated in roughly one month.

That means real users are already committing serious capital, and they are doing it early.

This is the key difference between a claim and a checkable fact:

- these are not numbers shown on a landing page

- these are not screenshots from a dashboard

- these are real PancakeSwap V3 positions that anyone can open and verify in one click

For reference, the vault contract used to deploy this liquidity is public and available here: https://bscscan.com/address/0xc03353F94613777B7C08360Be5D51Bb493a8B0F8

For me, this was the moment where the analysis stopped being theoretical.

The numbers clearly show that the protocol is not just “starting” — it is already operating with meaningful capital on-chain.

How This On-Chain Structure Translates Into Yield

This article focuses on the proof layer — how the system works on-chain and where the money actually goes.

But once you see that:

- user funds are deployed into real DeFi infrastructure (PancakeSwap V3)

- liquidity positions are public and verifiable

- capital is actively working in trading pools

…the next logical question becomes simple:

How can an investor participate in this structure?

This is exactly where Cyrus Finance positions itself as a structured access layer:

- it aggregates deposits

- deploys them into liquidity pools

- and provides predefined participation terms instead of manual DeFi management

I’ve already broken down the full participation model in my main review, including: available plans and durations, daily yield ranges, profit withdrawal and reinvestment logic and a step-by-step guide on how to start.

Full Cyrus Finance Review (plans, terms, returns): https://investleaks.pro/projects/cyrus-finance-review/

If you’re looking at this from an investor’s perspective, the takeaway is straightforward:

The protocol does not rely on promises. It relies on real liquidity, real trading activity, and verifiable on-chain data — and it reached a meaningful liquidity level in a very short time.

That combination is exactly what made this project worth digging into in the first place.

If You Prefer to Go Directly

If you don’t want to dig deeper into the technical side and prefer to move straight to participation, you can do that as well.

Cyrus Finance provides structured access to this on-chain mechanism, so you don’t need to manually manage liquidity pools, token ranges, or DeFi tools yourself.

You can explore the protocol and register here: https://cyrusfinance.xyz?ref=0x7dAbCc41c24a0384C28289E1E4f860124379a77D

Always verify the inviter wallet address inside the interface. Make sure its: 0x7dAbCc41c24a0384C28289E1E4f860124379a77D

If you have any questions — about registration, deposits, wallets, or elese — you can reach out to me directly.

📩 Telegram: @Denis_hbclub

📧 Email: news@investleaks.pro

Final Thoughts

I want to be clear about one important thing.

I personally treat Cyrus Finance as a high-risk, early-stage DeFi project. Like any project in this space, it may change, pause, break, or stop paying at some point. There are no guarantees here — and there never are in DeFi.

This is not a magic button and not a “set and forget” solution.

That’s exactly why I approached it the way I did.

Instead of trusting promises or marketing, I wanted to understand:

- where the money actually goes

- whether it works without a website

- and whether the system makes sense on-chain

By following the funds from the vault contract to real PancakeSwap V3 liquidity pools, I was able to verify that:

- capital is actively deployed

- liquidity is real and checkable

- and the protocol operates independently of the interface

This doesn’t eliminate risk — but it changes the quality of risk. For me, the key difference is simple: blind risk is guessing / informed risk is a decision.

That’s why I documented this investigation publicly.

If you decide to participate, do it with a clear understanding:

- this is an early-stage project

- capital should always be risk-managed

- and only amounts you are comfortable with should be involved

For some, this will be a reason to stay on the sidelines.

For others, it will be a reason to act early — with eyes open.

Both approaches are valid.

My goal with this article was not to convince everyone to invest.

It was to show what can be verified, what is real, and what actually happens on-chain.

Everything else is a personal decision.